Introduction :

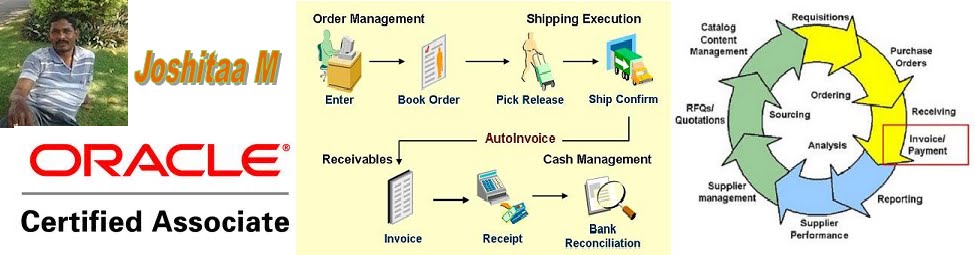

The deferred COGS of goods account is the new feature introduced in Release 12. The basic fundamental behind the enhancement is that the COGS is now directly matched to the Revenue. The same was not possible till now.

Prior to this enhancement, the value of goods shipped from inventory were expensed to COGS upon ship confirm, despite the fact that revenue may not yet have been earned on that shipment. With this enhancement, the value of goods shipped from inventory will be put in a Deferred COGS account. As percentages of Revenue are recognized, a matching percentage of the value of goods shipped from inventory will be moved from the Deferred COGS account to the COGS account, thus synchronizing the recognition of revenue and COGS in accordance with the recommendations of generally accepted accounting principles.

The Matching Principle is a fundamental accounting directive that mandates that revenue and its associated cost of goods sold must be recognized in the same accounting period. This enhancement will automate the matching of Cost of Goods Sold (COGS) for a sales order line to the revenue that is billed for that sales order line.

The deferral of COGS applies to sales orders of both non-configurable and configurable items (Pick-To-Order and Assemble-To-Order). It applies to sales orders from the customer facing operating units in the case of drop shipments when the new accounting flow introduced in 11.5.10 is used. And finally, it also applies to RMAs that references a sales order whose COGS was deferred. Such RMAs will be accounted using the original sales order cost in such a way that it will maintain the latest known COGS recognition percentage. If RMAs are tied to a sales order, RMAs will be accounted for such that the distribution of credits between deferred COGS and actual COGS will maintain the existing proportion that Costing is aware of. If RMAs are not tied to a sales order, there is no deferred COGS.

SETUP and ACCOUNTING :

Advanced Accounting setup:

Nav:Inventory → Setup → Organization → Intercompany Transaction Flow

Enter the Start and End Operating Unit (From Org and To Org) then choose type Shipping/Procuring and Start date.

bottom nodes block From Organization and To Organization (B) →Intercompany relations

1. AR Invoicing for shipping - Customer with Location

2.AP Invoicing for selling - Supplier with Site

To set the deferred COGS account.

Nav: Inv → Setup → Organization → Parameters → Other Accounts

A new account is added which is referred as the Deferred COGS accounts.

Please note that when upgrading from a pre R12 version the DEFERRED_COGS_ACCOUNT will be populated if it is null with the cost_of_goods_sold_account on the organization parameter. This can then be changed accordingly if a different account is required.

NEW ACCOUNTING : Release 12 :

When a Sales order is shipped the following accounting takes place:

The steps to generate such transactions are as follows:

Nav: Cost → COGS Recognition → Collect Revenue Recognition Information

Nav: Cost → COGS Recognition → Generate COGS Recognition Events

Nav: Cost → View Transactions → Material Transactions

The distribution for the COGS Recognition transaction associated with the Sales Order transaction now would be as follows:

Thus, essentially the recognized COGS balance is to move the value from Deferred COGS to COGS.

This particular COGS recognition transaction actually correspond to a revenue recognition percentage change.

You can view the transactions as :

Nav: Cost → View Transactions → Material Transactions → Distributions

A new COGS Revenue Matching Report shows the revenue and COGS information of sales order that fall within the user specified date range by sales order line

SIMPLER TERMS ( Table level details ) :

Once the whole cycle is complete we will have 2 transactions lines in mtl_material_transactions.

1. Sales Order

2. COGS Recognition transaction

Accounting will be in mtl_transaction_accounts and the Subledger accounting tables as follows:

Transaction 1:

The deferred COGS of goods account is the new feature introduced in Release 12. The basic fundamental behind the enhancement is that the COGS is now directly matched to the Revenue. The same was not possible till now.

Prior to this enhancement, the value of goods shipped from inventory were expensed to COGS upon ship confirm, despite the fact that revenue may not yet have been earned on that shipment. With this enhancement, the value of goods shipped from inventory will be put in a Deferred COGS account. As percentages of Revenue are recognized, a matching percentage of the value of goods shipped from inventory will be moved from the Deferred COGS account to the COGS account, thus synchronizing the recognition of revenue and COGS in accordance with the recommendations of generally accepted accounting principles.

The Matching Principle is a fundamental accounting directive that mandates that revenue and its associated cost of goods sold must be recognized in the same accounting period. This enhancement will automate the matching of Cost of Goods Sold (COGS) for a sales order line to the revenue that is billed for that sales order line.

The deferral of COGS applies to sales orders of both non-configurable and configurable items (Pick-To-Order and Assemble-To-Order). It applies to sales orders from the customer facing operating units in the case of drop shipments when the new accounting flow introduced in 11.5.10 is used. And finally, it also applies to RMAs that references a sales order whose COGS was deferred. Such RMAs will be accounted using the original sales order cost in such a way that it will maintain the latest known COGS recognition percentage. If RMAs are tied to a sales order, RMAs will be accounted for such that the distribution of credits between deferred COGS and actual COGS will maintain the existing proportion that Costing is aware of. If RMAs are not tied to a sales order, there is no deferred COGS.

COGS is now directly matched

to the Revenue

In summary :

1. If the SELLING_OU =

SHIPPING_OU, during an 'SO Issue' transaction always the deferred

COGS would be used and the COGS account would get reflected only

when the actual revenue recognition has happened, till then only the temporary deferred COGS would hold the cost.

2. If the SELLING_OU <> SHIPPING_OU, during an 'SO Issue' transaction Intercompany flows would come into picture and if a flow exists it would also check if 'Advanced Accounting' is enabled. If 'Advanced Accounting' is not enabled then COGS account would get costed, else Deferred COGS account would get costed.

when the actual revenue recognition has happened, till then only the temporary deferred COGS would hold the cost.

2. If the SELLING_OU <> SHIPPING_OU, during an 'SO Issue' transaction Intercompany flows would come into picture and if a flow exists it would also check if 'Advanced Accounting' is enabled. If 'Advanced Accounting' is not enabled then COGS account would get costed, else Deferred COGS account would get costed.

SETUP and ACCOUNTING :

Advanced Accounting setup:

Nav:Inventory → Setup → Organization → Intercompany Transaction Flow

Enter the Start and End Operating Unit (From Org and To Org) then choose type Shipping/Procuring and Start date.

bottom nodes block From Organization and To Organization (B) →Intercompany relations

1. AR Invoicing for shipping - Customer with Location

2.AP Invoicing for selling - Supplier with Site

To set the deferred COGS account.

Nav: Inv → Setup → Organization → Parameters → Other Accounts

A new account is added which is referred as the Deferred COGS accounts.

Please note that when upgrading from a pre R12 version the DEFERRED_COGS_ACCOUNT will be populated if it is null with the cost_of_goods_sold_account on the organization parameter. This can then be changed accordingly if a different account is required.

NEW ACCOUNTING : Release 12 :

When a Sales order is shipped the following accounting takes place:

- Inventory Valuation Account : Credit.

- Deferred COGS account : Debit

The steps to generate such transactions are as follows:

- Run the Collect Revenue Recognition Information program. This program will collect the change in revenue recognition percentage based on AR events within the user specified date range.

- Run the Generate COGS Recognition Events. This program will create the COGS recognition transaction for each sales order line where there is a mismatch between the latest revenue recognition percentage and the current COGS recognition percentage.

Nav: Cost → COGS Recognition → Collect Revenue Recognition Information

Nav: Cost → COGS Recognition → Generate COGS Recognition Events

Nav: Cost → View Transactions → Material Transactions

The distribution for the COGS Recognition transaction associated with the Sales Order transaction now would be as follows:

- Deferred COGS : Debit revenue percentage

- COGS : Credit (Actual revenue percentage )

Thus, essentially the recognized COGS balance is to move the value from Deferred COGS to COGS.

This particular COGS recognition transaction actually correspond to a revenue recognition percentage change.

You can view the transactions as :

Nav: Cost → View Transactions → Material Transactions → Distributions

A new COGS Revenue Matching Report shows the revenue and COGS information of sales order that fall within the user specified date range by sales order line

SIMPLER TERMS ( Table level details ) :

Once the whole cycle is complete we will have 2 transactions lines in mtl_material_transactions.

1. Sales Order

2. COGS Recognition transaction

Accounting will be in mtl_transaction_accounts and the Subledger accounting tables as follows:

Transaction 1:

- Inventory Valuation Account : Credit. (item_cost)

- Deferred COGS account : Debit (item_cost)

- Deferred COGS : Credit (Actual revenue percentage)

- COGS : Debit (Actual revenue percentage )

1.

In ship only flows the 'Close Line' activity will raise an costing

event to transfer the amount from DCOGS to COGS as there is no AR

intergartion.

2.1. No,when the line gets closed the 'Close Line' activity will raise an costing event to transfer the amount from DCOGS to COGS.

2.2. - It is done line by line not order by order.

Please run the following concurrent request to move DCOGS to COGS.

Nav: Cost → COGS Recognition → Collect Revenue Recognition Information

Nav: Cost → COGS Recognition → Generate COGS Recognition Events

Nav: Cost → View Transactions → Material Transactions

2.1. No,when the line gets closed the 'Close Line' activity will raise an costing event to transfer the amount from DCOGS to COGS.

2.2. - It is done line by line not order by order.

Please run the following concurrent request to move DCOGS to COGS.

Nav: Cost → COGS Recognition → Collect Revenue Recognition Information

Nav: Cost → COGS Recognition → Generate COGS Recognition Events

Nav: Cost → View Transactions → Material Transactions

Good article!!

ReplyDeleteThanks very nice blog!

ReplyDeleteMy webpage - check it out